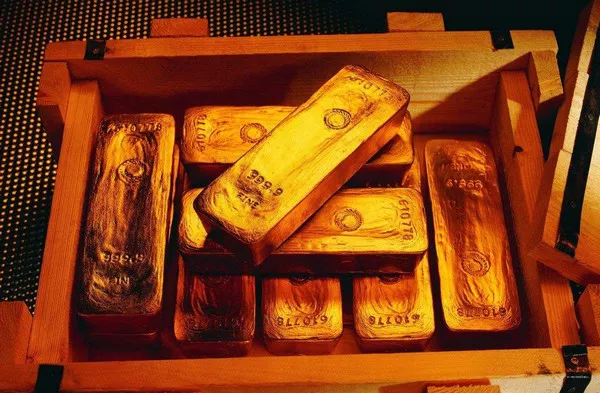

For the fourth consecutive day, the Dubai gold rate has remained steady at just over Dh369 per gram for 22K gold—a rare period of stability in the last six months. Typically, local gold prices fluctuate by Dh2-Dh4 daily, and sometimes even by Dh8-Dh10 per gram.

Following a slight spike in gold demand over Eid weekend, shopper turnout has been subdued. The next major gold and jewellery sales event will begin soon with Dubai Summer Surprises.

A jewellery retailer noted, “Other than price drops, what gold shoppers most value is price stability. They’ve had that these past few days, but prices will need to fall below Dh369 for many to buy more.”

Meanwhile, UAE gold owners are exploring new ways to capitalize on the current high prices through gold-backed loans.

Gold Loans on the Rise

Gold loans are becoming increasingly popular among UAE residents needing immediate funds but preferring alternatives to traditional bank loans. Once mainly used by small business owners for short-term cash needs, individuals are now also turning to gold loans.

“Borrowers can access up to 85% of their gold’s market value, offering substantial liquidity,” said Bandar Al Othman, Chairman of O Gold. “With competitive interest rates between 9% and 11%, significantly lower than unsecured loans, gold loans present a financially smart alternative. Coupled with gold’s inherent stability, this makes gold loans a reliable and growing financial tool.”

Industry insiders confirm a ‘mini-trend’ of gold-backed borrowing among UAE residents. “The market is shifting from simply buying gold at every price dip to maximizing the value of gold already owned,” said one source. “For short-term funding needs, gold loans are proving quite useful.”

Flexible Repayment Options

Finance House, a prominent UAE lender, offers gold loan programs allowing borrowers to choose between monthly instalments or a one-time ‘bullet’ payment at loan maturity. Their website promotes gold loans as ideal solutions for emergency expenses, personal needs, medical bills, business costs, home investments, or travel.

Current borrowing trends point toward financing travel and clearing payments related to home improvements.

Al Othman added, “Gold loan rates depend on factors like loan amount, gold purity, and market conditions. Our aim is transparency, providing clear information on loan terms and interest rates.”