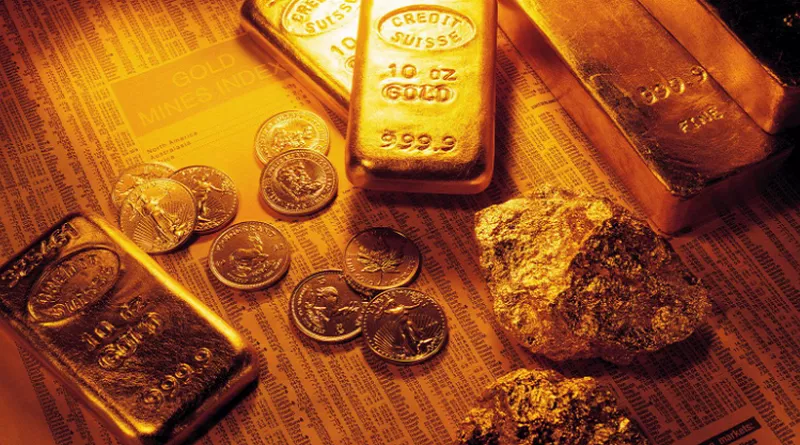

Gold prices recovered on Tuesday as bargain-hunters took advantage of lower prices, following a drop to a more than one-week low in the previous session. This decline was driven by a U.S.-China tariff truce that improved risk sentiment, reducing the appeal of gold as a safe-haven asset.

As of 0639 GMT, spot gold was up 0.6% at $3,254.39 per ounce, after falling 2.7% in the prior session. U.S. gold futures rose 1% to $3,258.70.

The recent tariff reductions announced after two days of talks in Geneva resulted in U.S. tariffs on Chinese imports dropping from 145% to 30%, and Chinese duties on U.S. imports falling from 125% to 10%. These moves helped boost global shares, as the trade war between the two countries, which had escalated in the previous month, appeared to ease.

KCM Trade Chief Market Analyst Tim Waterer noted that “there is some value-buying happening on gold at current levels,” which has supported the price, even as global growth prospects improve with the U.S. and China reaching better terms. “The consolidation move in the dollar has allowed the gold price to make a mild push higher.”

Federal Reserve Governor Adriana Kugler stated that the pause on tariffs reduces the likelihood that the Fed will need to lower interest rates in response to economic slowdown concerns. Traders are now focused on the U.S. Consumer Price Index (CPI) report due later today for clues on the Fed’s future monetary policy decisions. The market is expecting a 55-basis-point rate cut by the Fed this year, starting in September.

Waterer also mentioned that if the inflation data shows weaker-than-expected results, it could undermine the U.S. dollar and allow gold to make further gains. Gold traditionally thrives in a low-interest-rate environment, as it provides an alternative investment when the cost of holding other assets rises.

Meanwhile, Citi projected that gold will continue to consolidate within the $3,000 to $3,300 range in the short term, lowering its 0-to-3-month price target to $3,150.

Other precious metals saw gains as well, with spot silver rising 1.5% to $33.10 per ounce, platinum up 1.2% at $987.85, and palladium increasing 0.6% to $950.95.