Bian Ximing, a reclusive Chinese billionaire known for his early, lucrative gold trades, has now positioned himself as China’s biggest copper bull. With a near US$1 billion bet on copper futures, Bian is making waves in a market unsettled by escalating competition between the US and China.

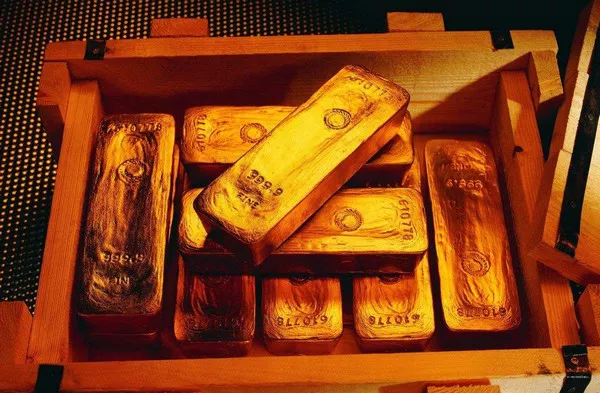

Bian first amassed his fortune in the plastic tube industry before retreating to a quiet life in Gibraltar. Over the past two years, he gained attention for his timely investment in Chinese gold futures, betting on a global shift away from the US dollar and inflation concerns. His fund capitalized on a historic rise in gold prices, generating an estimated US$1.5 billion in profits, according to Bloomberg.

Currently, amid trade tensions and an uncertain geopolitical climate, Bian and his brokerage, Zhongcai Futures, hold the largest net long position in copper contracts on the Shanghai Futures Exchange. Sources familiar with the matter reveal that after 10 months of buying, Bian’s combined personal and managed investments totaled nearly 90,000 tonnes in copper futures as of May 16—surpassing all other market players.

Despite some investors withdrawing amid geopolitical instability, Bian intends to maintain this massive copper position. This reflects his strong confidence in the metal and in China’s economy, the world’s largest consumer of copper. The sources, who requested anonymity due to the private nature of the discussions, described Bian’s stance as unusually long-term and fundamentally driven, contrasting with the short- to mid-term trading strategies typical in the market.

Li Yiyao, Vice-President of Cofco Futures’ Shanghai North Bund division, highlighted the uniqueness of Bian’s position: “It reflects a very long-term, bullish sentiment on the metal based on fundamentals—very different from the usual mid or short-term strategies we see.” She also noted Bian’s steady commitment during the height of the trade turmoil, when many others exited.

Bian stands among a select group of larger-than-life figures who have shaped China’s commodities trading over the past two decades, alongside industry pioneers like Xiang Guangda, He Jinbi, and Ge Weidong.

Unlike many physical traders, Bian’s approach is characterized by a deep understanding of the market’s complexity, which remains difficult for outsiders to decode. Despite his success, Bian remains notably private, managing his Chinese investment team and Zhongcai Futures remotely from Gibraltar. He relocated more than a decade ago, attracted by the climate and proximity to European assets, and rarely returns to China.

Nevertheless, Bian has earned a loyal following in China for his Warren Buffett-style investment philosophy, shared through online musings that appeal to investors seeking a more traditional, disciplined hedge fund strategy, in contrast to the often speculative practices common in local markets.