In today’s fragile political and financial landscape, gold is reclaiming a vital role in the reserve management strategies of cautious central banks and institutional investors.

“Gold is good when other assets are not safe,” remarked a participant at the recent OMFIF annual seminar in London, co-hosted with State Street Global Advisors. The event gathered senior officials from central banks, public pension funds, and sovereign wealth funds to explore how rising geopolitical risks and evolving market dynamics are reshaping reserve portfolios.

A Strategic Repositioning of Gold

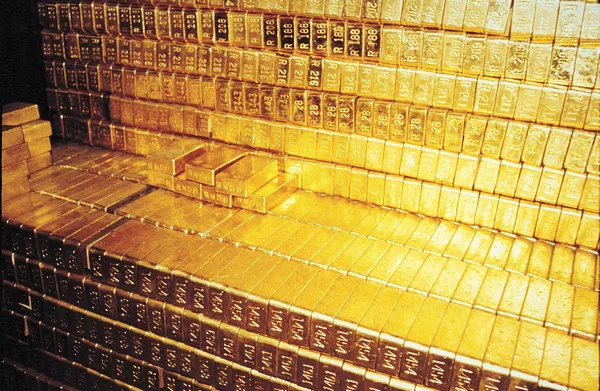

Central banks have now sustained three consecutive years of strong gold buying, culminating in record quarterly purchases of 365 tonnes in Q4 2024, according to the World Gold Council. This follows annual acquisitions exceeding 1,000 tonnes in both 2022 and 2023. Leading buyers include China, Turkey, and India, alongside smaller economies like Poland, Hungary, and the Czech Republic, which have also boosted their gold holdings relative to their reserve sizes.

This shift transcends tactical trading. As outlined in OMFIF’s 2024 report, Gold and the New World Disorder, gold is increasingly valued as a strategic asset—not for yield or efficiency—but for its symbolic representation of political neutrality and security. It stands apart as an independent store of value, free from the risks tied to any single issuer. What was once considered a theoretical hedge is now driving tangible portfolio reallocations.

Geopolitical Concerns Accelerate the Trend

The return of US President Donald Trump has reignited fears around trade tensions, fiscal imbalances, and the reliability of global alliances. The politicization of the US dollar itself is now a pressing concern, even among long-standing American partners.

As one roundtable participant explained, the real issue is less about Trump’s specific actions and more about how swiftly markets respond to tariff changes and how prolonged such uncertainties might be. Central banks are thus bracing for a more fragmented global financial system.

Gold as a Pillar of Stability

There was broad agreement among seminar participants that ongoing volatility—fueled by sanctions, shifting trade policies, and geopolitical risks—has heightened the urgency for diversification, bringing gold into sharper focus. One expert described gold’s role as evolving from a traditional safe haven to a fundamental stabilizer within reserve portfolios.

Another emphasized that gold has become the refuge of choice when conventional assets appear unsafe, with record prices reflecting trust rather than speculative frenzy. Strategic autonomy and long-term resilience increasingly shape reserve management decisions, and gold uniquely aligns with these priorities.

Limited Alternatives to the Dollar

Other potential diversifiers to the US dollar face significant hurdles. The euro struggles with structural limitations and institutional incompleteness. Despite growing use in trade, the renminbi lacks the convertibility, transparency, and liquidity essential for a global reserve currency. Currencies such as the yen, pound, and the Canadian and Australian dollars are similarly constrained by scale and liquidity.

“This isn’t mass de-dollarization,” noted a panelist. “It’s a gradual repositioning driven by a structural loss of trust.”

Gold: The Last Strategic Fallback

In the absence of viable alternatives, gold has emerged as the primary strategic fallback. Though not a currency, it effectively functions as one during times of crisis.

The forthcoming Global Public Investor 2025 report, due on June 24, will examine whether this trend has translated into a lasting increase in gold’s share of global reserves. For four years running, surveys of central banks reveal plans to raise gold allocations—and the latest data confirm this is becoming reality.